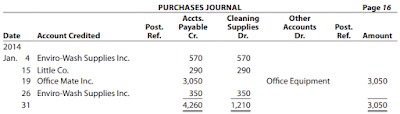

Purchases Journal Page 16

Date Account Credited

Post.

Ref.

Accts.

Payable

Cr.

Cleaning

Supplies

Dr.

Other

Accounts

Dr.

Post.

Ref. Amount

2014

Jan. 4 Enviro-Wash Supplies Inc. 570 570

15 Little Co. 290 290

19 Office Mate Inc. 3,050 Office Equipment 3,050

26 Enviro-Wash Supplies Inc. 350 350

31 4,260 1,210 3,050

a. Prepare a T account for the accounts payable creditor accounts.

b. Post the transactions from the purchases journal to the creditor accounts, and determine their ending balances.

c. Prepare T accounts for the accounts payable control and cleaning supplies accounts. Post control totals to the two accounts, and determine their ending balances. Cleaning Supplies had a zero balance at the beginning of the month.

d. Prepare a schedule of the creditor account balances to verify the equality of the sum of the accounts payable creditor balances and the accounts payable controlling account balance.

e. How might a computerized accounting system differ from the use of a purchases journal in recording purchase transactions?

Answer:

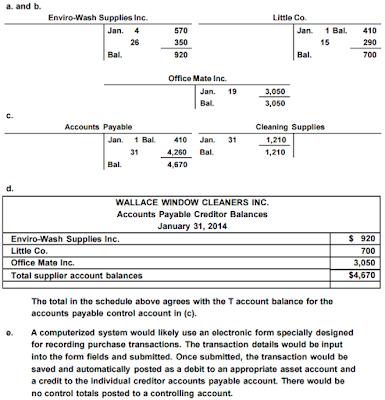

a. and b.

Enviro-Wash Supplies Inc. Little Co.

Jan. 4 570 Jan. 1 Bal. 410

26 350 15 290

Bal. 920 Bal. 700

Office Mate Inc.

Jan. 19 3,050

Bal. 3,050

c.

Accounts Payable Cleaning Supplies

Jan. 1 Bal. 410 Jan. 31 1,210

31 4,260 Bal. 1,210

Bal. 4,670

d.

WALLACE WINDOW CLEANERS INC.

Accounts Payable Creditor Balances

January 31, 2014

Enviro-Wash Supplies Inc. $ 920

Little Co. 700

Office Mate Inc. 3,050

Total supplier account balances $4,670

The total in the schedule above agrees with the T account balance for the

accounts payable control account in (c).

e. A computerized system would likely use an electronic form specially designed

for recording purchase transactions. The transaction details would be input

into the form fields and submitted. Once submitted, the transaction would be

saved and automatically posted as a debit to an appropriate asset account and

a credit to the individual creditor accounts payable account. There would be

no control totals posted to a controlling account.

No comments:

Post a Comment